Manual processes, customer retention, underwriter effectiveness, customer service response, and claims cycle times, risk mitigation, regulatory compliance, incident, fraud management are all areas of typical challenges that are undergoing digital automation. The organizations that understand the compelling need for this transformation, and that take advantage of the tools available today to increase operational efficiency and streamline critical Line of Business (LOB) processes, will be leaders in the industry for years to come.

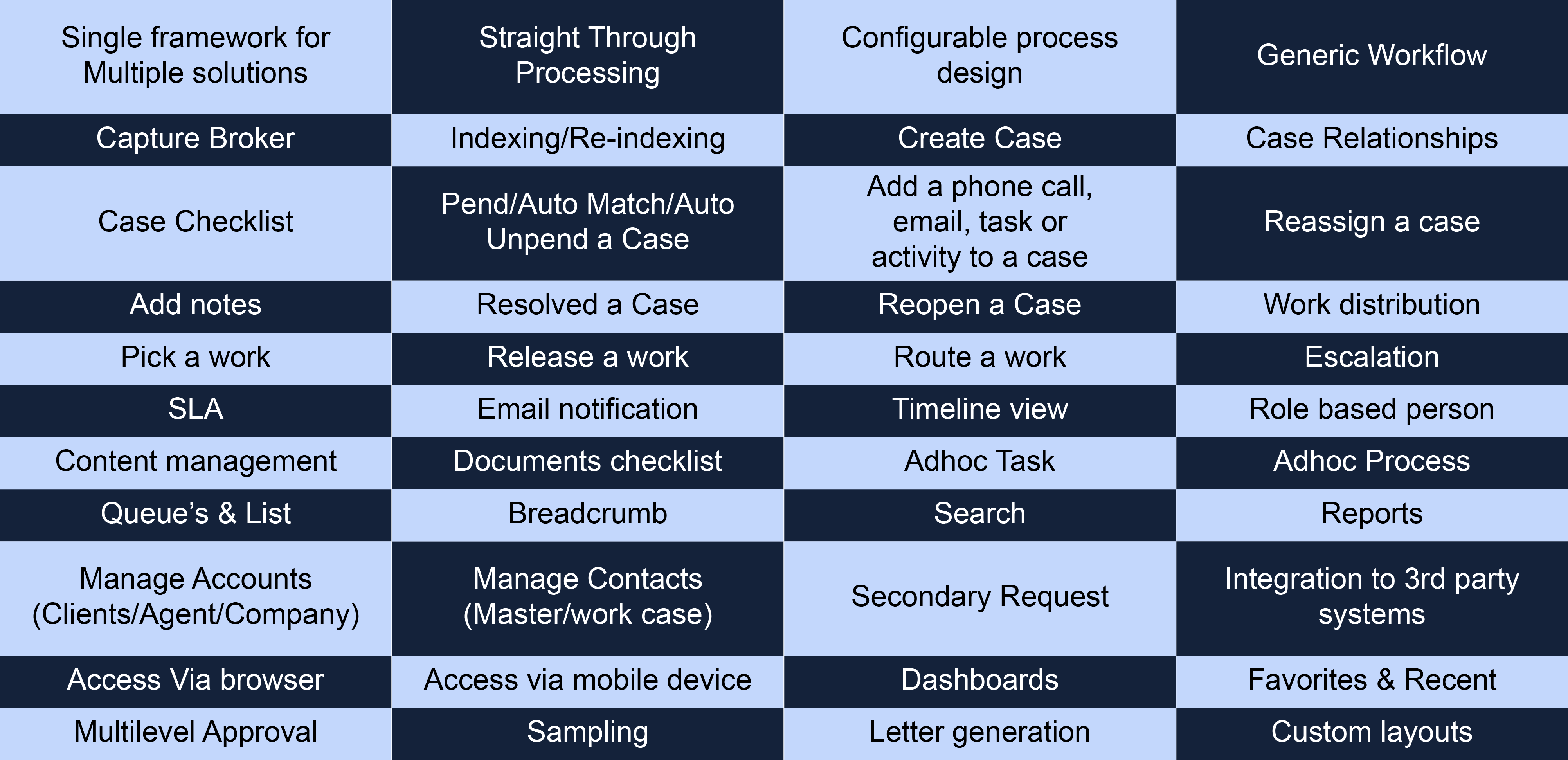

The Active Client Management(ACM) application leverages the underlying Client Management framework built on top of OpenText Process Suite technologies such as entity, case, content and process management to deliver a fast start implementation of operational case management such as ACM for Insurance, Banking, Wealth Management, Worker’s Compensation and more. It provides a 360º view of an entity such as customers, brokers, agents and other third party intermediaries’ casework, processes, content, correspondence and insights. The ACM customer centric entity, case, content and process management optionally can be integrated with OpenText Capture Center (OCC), Client Communication(Streamserve) and Analytics (Process Intelligence) to extend the capabilities of existing line of business (LOB) systems and externally managed processes. The application delivers end to end customer centric dynamic and collaborative case management low code implementation within the core back office of customer, agent and adviser service operations to increase customer retention and focus on the whole customer experience More Info

• New Account Opening: Quickly process applications and onboard new customers and new policies

• Client Servicing: Let policyholders maintain their policies online, saving time for both them and you

• Claims Management : Process claims faster and more consistently with smarter automation and best-practice guidance for employees

• Business Intelligence : Track key performance indicators (KPIs) and gain insight through analytics covering each process automated

• Automated Information capture and communications: Integrations with OpenText™ Capture Center and OpenText™ Communications Center remove paper from your processes and deliver personalized communications to customers in the right channels, and with rich interactivity

• Audit Trails : Capture a complete audit trail of all documents and actions

• Built on low-code development environment : Easily configure and customize to your business with significantly less time and effort than traditional business process management platforms or off-the-shelf applications

• Mobile Support : Serve customers in their preferred channels without investing in a separate mobile web platform

The integration between the Document Management System (DMS) and the Artificial Intelligence (AI) system offers a comprehensive and intelligent solution to address regulatory compliance, fraud detection, insurance claim processing, semantics, and contextual document search, as well as seamless collaboration. The AI system acts as a virtual assistant, leveraging advanced natural language processing and machine learning capabilities to analyze documents, ensure regulatory adherence, detect potential fraud, facilitate insurance claim completion, enable efficient document retrieval, and foster streamlined collaboration among users.