Manual processes, customer retention, underwriter effectiveness, customer service response, and claims cycle times, risk mitigation, regulatory compliance, incident, fraud management are all areas of typical challenges that are undergoing digital automation. The organizations that understand the compelling need for this transformation, and that take advantage of the tools available today to increase operational efficiency and streamline critical Line of Business (LOB) processes, will be leaders in the industry for years to come.

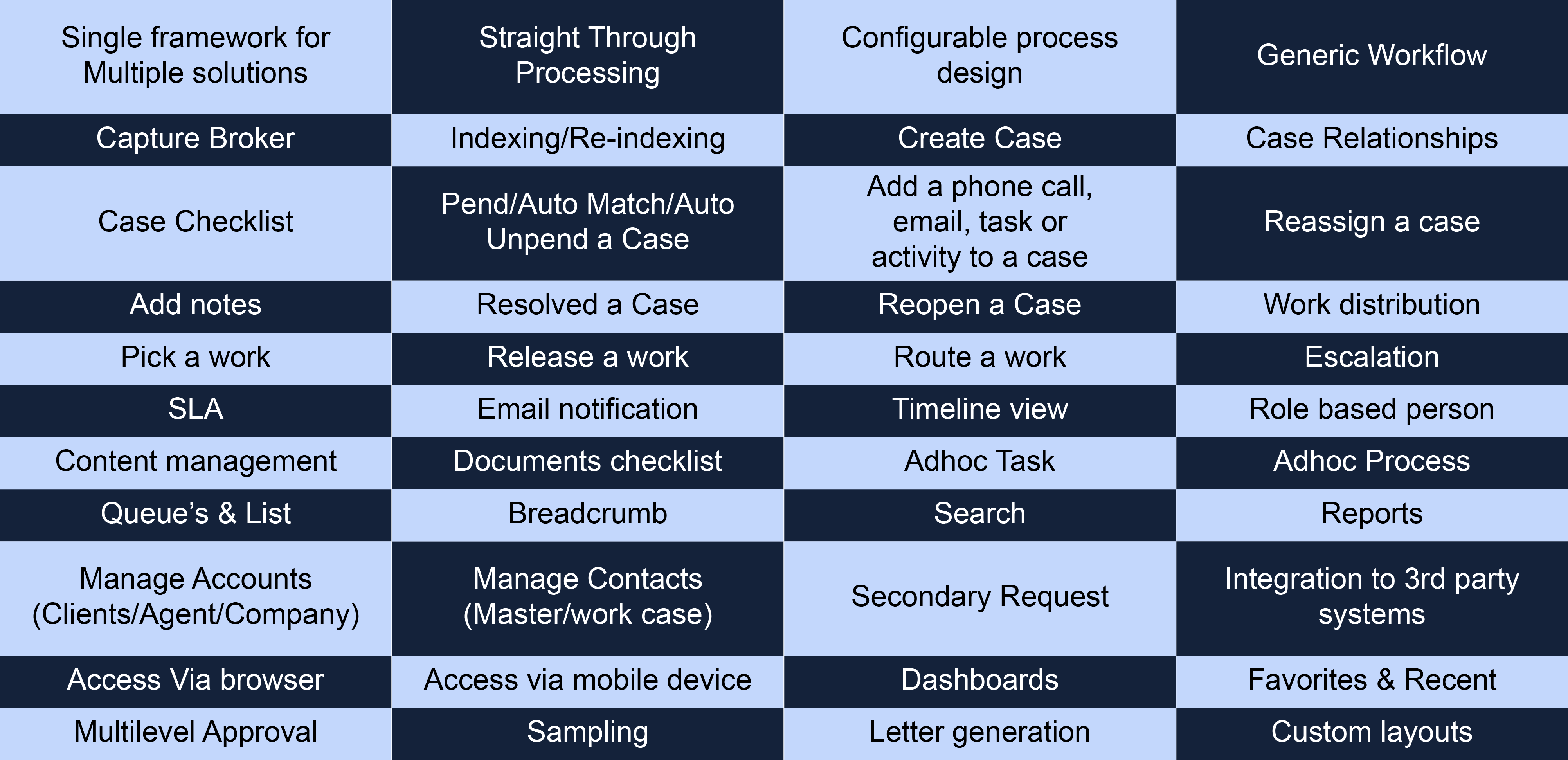

The Active Client Management(ACM) application leverages the underlying Client Management framework built on top of OpenText Process Suite technologies such as entity, case, content and process management to deliver a fast start implementation of operational case management such as ACM for Insurance, Banking, Wealth Management, Worker’s Compensation and more. It provides a 360º view of an entity such as customers, brokers, agents and other third party intermediaries’ casework, processes, content, correspondence and insights. The ACM customer centric entity, case, content and process management optionally can be integrated with OpenText Capture Center (OCC), Client Communication(Streamserve) and Analytics (Process Intelligence) to extend the capabilities of existing line of business (LOB) systems and externally managed processes. The application delivers end to end customer centric dynamic and collaborative case management low code implementation within the core back office of customer, agent and adviser service operations to increase customer retention and focus on the whole customer experience More Info

• New Account Opening: Quickly process applications and onboard new customers and new policies

• Client Servicing: Let policyholders maintain their policies online, saving time for both them and you

• Claims Management : Process claims faster and more consistently with smarter automation and best-practice guidance for employees

• Business Intelligence : Track key performance indicators (KPIs) and gain insight through analytics covering each process automated

• Automated Information capture and communications: Integrations with OpenText™ Capture Center and OpenText™ Communications Center remove paper from your processes and deliver personalized communications to customers in the right channels, and with rich interactivity

• Audit Trails : Capture a complete audit trail of all documents and actions

• Built on low-code development environment : Easily configure and customize to your business with significantly less time and effort than traditional business process management platforms or off-the-shelf applications

• Mobile Support : Serve customers in their preferred channels without investing in a separate mobile web platform

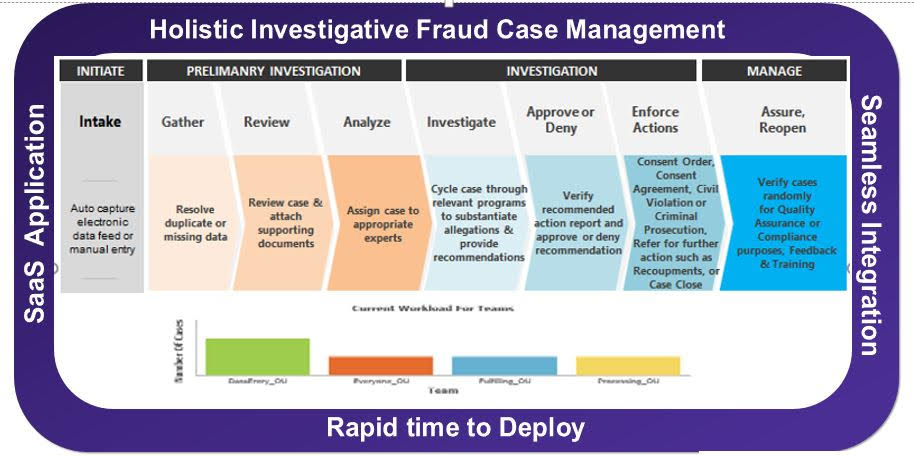

In an era characterized by rapid technological progress and intricate financial landscapes, the demand for a robust system to manage fraud complaints has never been more significant. We are thrilled to introduce our cutting-edge case management solution, meticulously crafted to revolutionize the approach to handling fraud complaints across both public and private sectors. Whether it's government entities safeguarding public funds or financial institutions securing their clients' assets, our case management system provides a truly comprehensive 360-degree perspective on complainant and investigator casework.

Our solution seamlessly integrates with OpenText Developers Cloud Services (OTDCS), offering data-driven insights and adaptable case workflows. This not only expedites the resolution of fraud complaints but also empowers investigators to foresee and proactively mitigate future risks.

Our Fraud Case Management offers a panoramic view of complainants' and investigators' casework, encompassing processes, content, and tasks. This solution accelerator, built using OpenText Developers Cloud Services, enables customers to swiftly implement a customer-centric case management system for Fraud Management within their organization's core back-office and customer service operations.

As this application is SaaS-based and ready for deployment, it requires only configuration to align with each customer's unique requirements. Furthermore, the integration of Artificial Intelligence enhances its capabilities, allowing customers to: a) effortlessly utilize natural language semantics search for content and historical data at case level, including complainant-specific information, b) Create concise document summaries, c) Generate polished email communications, d) Efficiently produce correspondence and e) establish a knowledge graph using generative AI

The advantages are manifold:

Developing a case management system to manage fraud offers several advantages: